China’s loss is Japan’s gain as investors funnel funds to Asia’s other stock markets amid the sluggish mainland recovery

China is not providing a risk-reward scenario that is ‘good enough’ for investors, raising interest in alternative opportunities, a strategist says

A net inflow of US$21.6 billion so far this quarter has lifted Japan’s stock benchmark to a level not seen in more than three decades

Asian stock markets such as Japan are now the hottest bet as investors turn away from China’s sluggish recovery and chase equity opportunities elsewhere in the region, according to strategists.

Disappointing economic data and rising geopolitical tensions are making global investors – whose confidence in China has not been fully restored following Beijing’s regulatory crackdowns since 2020 – increasingly cautious, Charu Chanana, Saxo Markets’ Asian strategist based in Singapore, said in an interview with the Post.

And that has made other markets in the region look more interesting, helping them attract capital grown weary of China’s reopening trade.

“China has not been able to provide a risk reward that is good enough for investors,” Chanana said. “[Therefore] investors have been trying to find alternative opportunities in emerging markets, as well as Asia more broadly.”

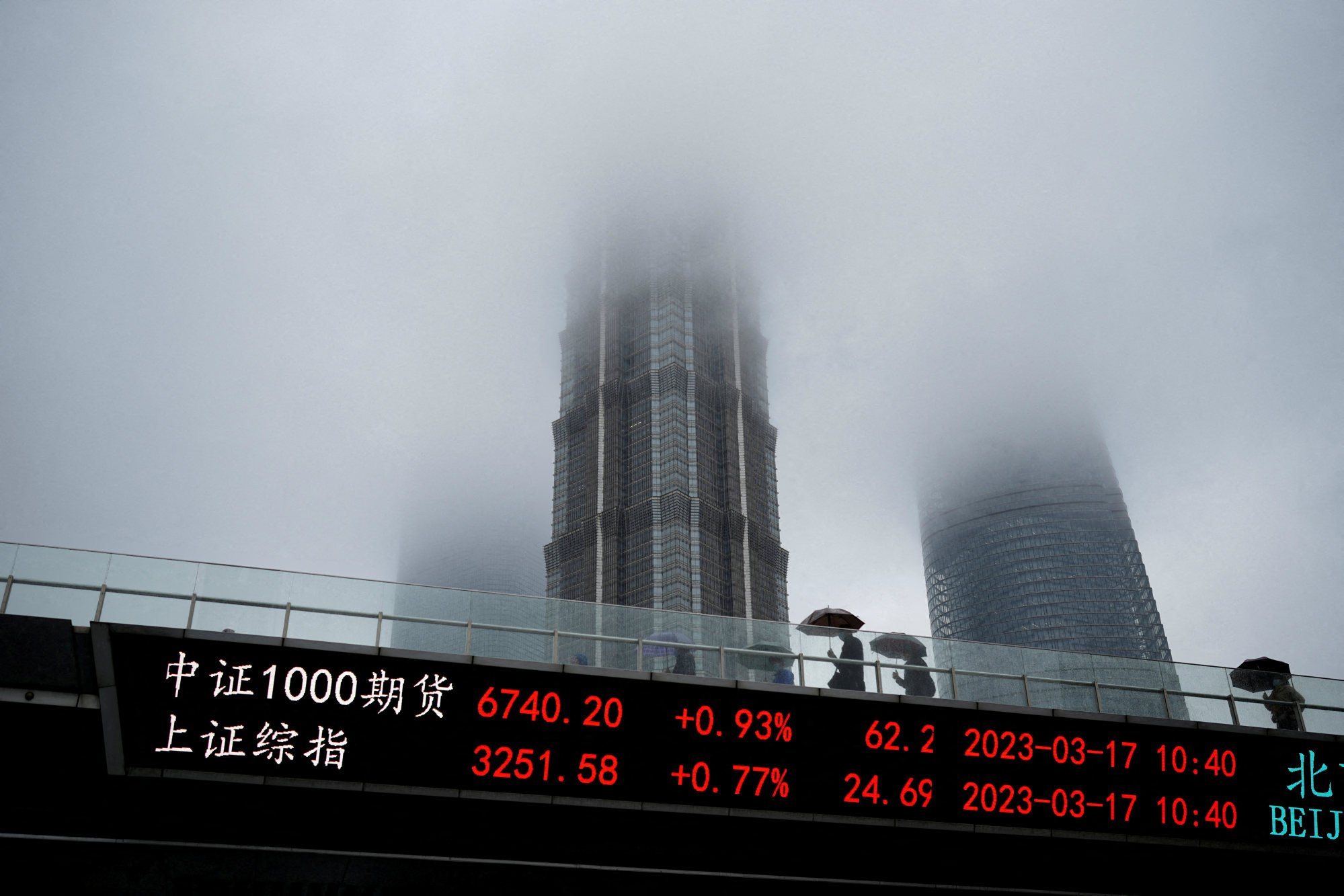

Chinese stocks have been in a rut after a slower-than-expected economic recovery split the market over the growth outlook for the rest of 2023. Benchmarks in mainland China and Hong Kong have barely budged over the past two months, with neither the bulls nor the bears displaying strong conviction.

Investors have slowed their purchases of mainland Chinese stocks globally amid cautious sentiment. They have bought only US$1 billion worth of A shares so far in the second quarter, a drastic drop compared with US$27 billion in purchases in the first three months of 2023, Stock Connect data shows.

Meanwhile, Japan’s fundamentals have improved significantly with the return of inflation and corporate governance reforms, which are fuelling a fast turnaround, Chanana said. Capital flows have reversed from a bearish trend earlier this year and picked up sharply since April, with a net inflow of US$21.6 billion so far in the second quarter, according to Goldman Sachs.

That has helped lift Japan’s stock benchmark to a level not seen in more than three decades. The Nikkei 225 Index rose for a 12th straight day on Monday to 31,086.82, the highest since 1990. The benchmark has rallied over 10 per cent since April, adding US$193 billion of market value to the country’s stock market, according to Bloomberg data.

Japan’s economic recovery and the “not-China trade” are all piquing interest in Japan’s market, Daniel Hurley, portfolio specialist for emerging markets and Japan equities at T Rowe Price, said in a note on Monday. “We believe that we are only at the start of the market appreciating this.”

While most traders are bearish on China, that means the market has priced in too much risk, so China stocks are more likely to gain than fall during the next two months, albeit not by much, according to Redmond Wong, Saxo’s market strategist for Greater China.

“If you ask me either way, I would put a little more money on the upside, less on the downside,” Wong said. “But the market is likely to trade in a small range.”

Source: South China Morning Post

Ακολουθήστε το

Ακολουθήστε το