Είναι δυνατόν η Τουρκία να γίνει η νέα χώρα-σύνδεσμος για το φυσικό αέριο

– Analysis

By Gulshan Dietl, IDSA November 7, 2013

Largely unaffected by the stagnation in most of the

developed world, the Turkish economy has continued to grow and stands at $800

million today. Consequently, its demand for energy has increased and is

expected to double over the next decade, according to the International Energy

Agency.

Natural gas accounts for an increasing share of the energy basket in

Turkey. Its gas-generated electricity demand growth is estimated to be even

higher.

Turkey’s natural gas reserves are 218 billion cubic

feet (bcf) and its production is roughly 27 bcf. In the circumstances, it

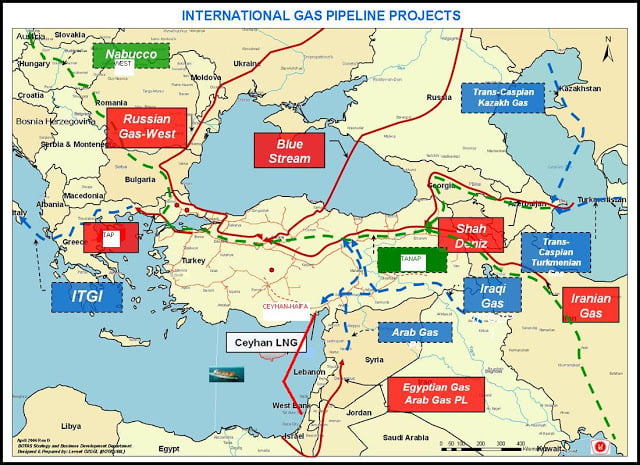

relies heavily on imports to meet its domestic demand. Additionally, Turkey

positions itself as a gas transit hub – importing from Russia, Azerbaijan,

Turkmenistan and Iran and re-exporting some of it to Europe. More importantly,

it provides passage from the gas production sites to the consumers. Today, it

holds a privileged location between the substantial gas reserves of the Caspian

basin and Russia and the substantial market in Europe.

In 2011, the country imported approximately 890 bcf

from Russia via the underwater Black Sea Blue Stream pipeline, about 290 bcf

from Iran via the Tabriz-Dogubayazit pipeline, and approximately 140 bcf from

Azerbaijan via the Baku-Tbilisi-Erzerum pipeline. The latter one is expected to

be integrated into the Southern Gas Corridor pipelines – a European Union initiative

to secure gas from the Caspian.

A critical scrutiny of the prospects for Turkey’s

emergence as the natural gas hub is in order. The domestic demand is growing

leaving little surplus to meet re-export commitment – especially during the

peak months. The gas infrastructure has been vulnerable to frequent terrorist

attacks leading to supply disruptions. The Baku-Tbilisi-Erzerum pipeline or any

other pipeline entering from Georgia has to pass through Turkey’s Kurdish

region, where the attacks from the militant rebels have increased in frequency

and damage. The pipeline from Iran has also witnessed sabotages.

Regionally, the Interconnector Turkey-Greece-Italy

(ITGI) transportation project from the Shah Deniz gas field in Azerbaijan to

Italy has had positive fallout in Turkey’s relations with Greece. The initial

agreement between the Turkish state pipeline company BOTAS and the Greek gas

company DEPA led to the laying of the pipeline by the Turkish Prime Minister

Recep Tayyip Erdogan and the Greek Prime Minister Kostas Karamanlis in 2005 – a

milestone in decades of distrust and hostility between the two nations. The

pipeline is operational since 2007.

On the other hand, Turkey is entering into troubled

waters in its quest for more pipeline options in the region. The BOTAS has

already started building a large pipeline toward northern Iraq planning to

import gas from the Iraqi Kurdistan. The project is bound to invoke opposition

from the central Iraqi government in Baghdad. The Turkish Minister of Energy and

Natural Resources Taner Yildaz has also expressed interest in playing a large

role in importing and re-exporting Israel’s gas deposits from the Leviathan gas

field. Implementation of the project will have negative fallouts for the

Turkish regional policies.

The Qatar-Turkey agreement to build a pipeline

originating in Qatar and moving through Saudi Arabia, Jordan and Syria reaching

Turkey has been perceived to be one of the major reasons for the uprising in

Syria. A pliable regime in Syria would have been an absolute prerequisite in

its implementation. The Turkey-Iraq Pipeline and the Arab Pipeline from Egypt

have not been realized due to the political instability in the region. The gas

imports from Iran have remained static in view of the sanctions on the country.

Beyond the region, Turkey suffers at times and

benefits at others from the global scramble for a share in the gas resources.

It has been a contested territory for rival pipeline proposals – the most

interesting being the South Stream project of Russia and the Nabucco project of

the West. The South Stream pipeline proposes to carry gas from the Russian

Black Sea coast in Krasnodar Krai through an off-shore pipeline under the Black

Sea to the Bulgarian landfall near Varna and a connecting on-shore pipeline

from there to Greece, Italy and Austria. In 2009, the pipeline was rerouted

through the Turkish exclusive economic zone to avoid the Ukrainian exclusive

economic zone as Russia and Ukraine fell out on the terms of the agreement. An

ambitious project to deliver 63 bcm of gas annually, it is expected to start

its commercial operation by the end of 2015.

The Nabucco, originally proposed in 2002, was to

follow roughly the same route as the South Stream. A decade later, it was

revised as Nabucco-West which would have been a shorter and a more modest

version. The Nabucco-West would have been a commercially viable and

logistically advantageous proposal but the risks of causing a gas glut in the

market and of raising tensions with Russia doomed its prospects. In June this

year, its fate was finally sealed when the Trans-Adriatic Pipeline (TAP) was

chosen as a route from the Shah Deniz II fields in Azerbaijan to Western

Europe. The TAP will connect with the Trans Anatolian Pipeline (TANAP) near the

Turkey-Greece border in Kipoi, cross Greece, Albania and the Adriatic Sea

before coming ashore in southern Italy.

Rotterdam is the undisputed leader as the hub for

crude oil. It is one of the world’s largest ports with a huge rail, road, air

and sea network. Handing the cargo, managing trans-shipment, operating

refineries and petrochemical plants, the city has acquired the title of

“Gateway to Europe”.

So, will Turkey be the hub for gas tomorrow like

Rotterdam is the hub for oil today? Its ambition to emerge as a major conduit

of gas to Europe suffers from an inherent limitation; the future growth in

energy demand will be from Asia and not Europe.

Views expressed are of the author and do not

necessarily reflect the views of the IDSA or of the Government of India.

Originally published by Institute for Defence Studies

and Analyses (www.idsa.in) at http://www.idsa.in/idsacomments/WillTurkeybethenewhubforgas_gdietl_06111

The Institute for Defence

Studies and Analyses (IDSA) is a non-partisan, autonomous body

dedicated to objective research and policy relevant studies on all aspects of

defence and security. Its mission is to promote national and international

security through the generation and dissemination of knowledge on defence and

security-related issues. IDSA has been consistently ranked over the last few

years as one of the top think tanks in Asia.

Ακολουθήστε το

Ακολουθήστε το